Beat the BOIR Deadline—

File Fast. File Right.

Avoid costly penalties of $591 per day. Our experts handle your Beneficial Ownership Information Report (BOIR) filing in minutes—100% compliance guaranteed.

Avoid costly penalties of $591 per day. Our experts handle your Beneficial Ownership Information Report (BOIR) filing in minutes—100% compliance guaranteed.

Why Choose Us

Why Choose Us

✅ Trusted by 1,000+ Small Business Owners

🕒 Same-Day Filing Available

🔒 Secure & Compliant Process

🤝 100% Satisfaction Guarantee—

No Compliance, No Charge.

🤝 100% Satisfaction Guarantee—No Compliance, No Charge.

⚡ Done-for-You Simplicity

🚨 Filing Deadline Looming

(March 21, 2025)

Trusted Experts in BOIR Compliance. File Worry-Free.

* Complete this quick form to secure your spot and speak with a BOIR compliance expert.

Commonly Asked questions

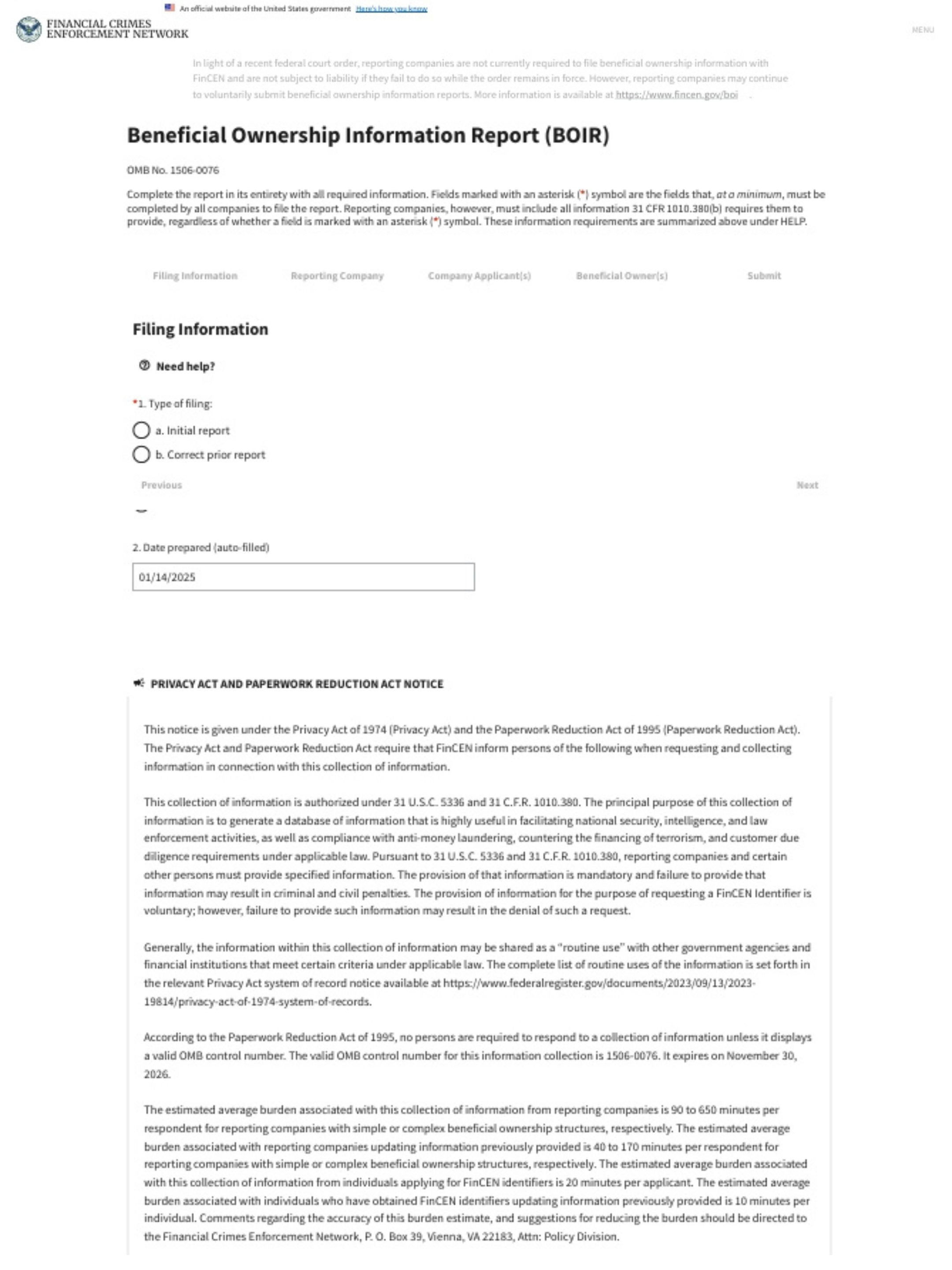

The Corporate Transparency Act is a law that’ll require millions of the nation’s smallest business entities to report beneficial owner information (BOI) to the Financial Crimes Enforcement Network (FinCEN) starting in 2024. (FinCEN is a bureau of the U.S. Department of the Treasury.)The law was enacted because “illicit actors” often set up small LLCs and corporations as shell companies, or fronts, to hide the identities of owners who are engaged in money laundering, financing terrorism, and other illegal activities.

The current suspension on enforcement of the Corporate Transparency Act is temporary. The Department of Justice is appealing the preliminary injunction. In the meantime, FinCEN is continuing to accept Beneficial Ownership filings.

According to FinCEN, the term beneficial owner includes any individual who, directly or indirectly, either

- Exercises substantial control over a reporting company (meaning they can make important decisions for the company)

or

- owns or controls at least 25 percent of the ownership interests

Small businesses that match these criteria can file BOI reports:

- Have 20 or fewer full-time employees and less than $5 million in sales

and

- Are LLCs, limited liability partnerships, corporations, business trusts, or other entities created by filing with a Secretary of State, tribal jurisdiction, or similar office

- Foreign LLCs and corporations that are registered to do business in any state or tribal jurisdiction

Organizations with more than 20 full-time employees and over $5 million in annual gross receipts are excluded from reporting requirements.

There are 23 entity types exempt from BOIR requirements:

- Securities reporting issuer

- Governmental authority

- Bank

- Credit union

- Depository institution holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agency

- Other Exchange Act registered entity

- Investment company or investment adviser

- Venture capital fund adviser

- Insurance company

- State-licensed insurance producer

- Commodity Exchange Act registered entity

- Accounting firm

- Public utility

- Financial market utility

- Pooled investment vehicle

- Tax-exempt entity

- Entity assisting a tax-exempt entity

When there’s a change to your business or beneficial ownership information, you’re required to update FinCEN within 30 days of the change. Examples of a change include:

- The business address changes

- A beneficial owner moves and changes their address

- A beneficial owner gets married and changes their name

- A beneficial owner’s passport or driver’s license needs to be renewed

- A beneficial owner was previously a minor and comes of age

A federal court temporarily paused enforcement of the Corporate Transparency Act which requires businesses to report their beneficial ownership information to FinCEN. Although not mandatory, FinCEN is still accepting beneficial ownership filings.

We know this can be a confusing time for business owners navigating compliance, so we offer a free consultation as a guide to help you understand and file the Beneficial Ownership Information (BOI) form.

Contact us at 1(888)300-4145

At Solid Ground Consultants, we’re staying on top of these developments to ensure small business owners have the resources they need to make informed decisions.

Questions? Call Now!

1(888)300-4145

Stay Compliant and Avoid Fines – Get Help with Your BOIR Filing Today!

BOIR filing is mandatory for the majority of businesses. Ensure you're compliant and avoid penalties with expert assistance.

Penalties for Late Filing:

Questions? Contact us!

BOIR Filing Made Easy – Professional Assistance to Keep Your Business in Good Standing

Did you know that failing to file your BOIR (Beneficial Ownership Information Report) on time can lead to significant penalties?

Our experts are here to guide you through the entire filing process to ensure your business remains compliant with federal regulations. Let us help you get it right the first time!

Questions? Contact us!

What Is the BOIR and Why You Need to File It

The Beneficial Ownership Information Report (BOIR) is a critical document that businesses must submit to the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN).

Filing this report provides key information about the individuals who own or control your business – known as beneficial owners. It is a mandatory requirement for most businesses in the U.S. under the Corporate Transparency Act (CTA).

If you fail to file the BOIR correctly and on time, your business could face hefty fines or legal action.

Why Choose Us

Why Business Owners Trust Us for Their BOIR Filing

Ready to get this paper work out of you life? Contact us today and discover how quickly we can get you compliant!

Risk of missing deadline

Don't Risk Fines or Legal Issues – File on Time

Under the Corporate Transparency Act, businesses are required to file their BOIR with FinCEN. Failure to file or late filing can result in:

Contact Solid Ground Consultants for

Your Free Consultation

Have questions or need a consultation? Fill out the form, and one of our BOIR filing experts will reach out to you shortly.

Let us help you navigate your BOIR paperwork with confidence and ease!

Questions? Contact us!

simple & fast filing

How Our BOIR Filing Process Works

Step-by-step Process:

Affordable Pricing for BOIR Filing Assistance

We offer transparent and competitive pricing. The cost of our service is tailored to your business needs, with no hidden fees. Get in touch for a free consultation and personalized pricing.

Questions? Call Now!

1(888)300-4145